The Unsustainable Burden of Sustainability Gadgets

08/05/2019

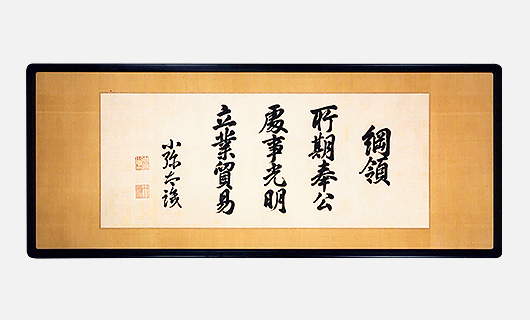

When “Values” is more than a Word – The Mitsubishi case

26/06/2019For many years we have pointed raging fingers to the excessive focus of the economic world on Finance. Aiming at a conversion to sustainability and circularity of the economy we condemned the short-termism plaguing executives minds and consequently their decisions. A lack of industrial strategy and vision that made for too frequent breaking up of entire Value Chains in order to maximize the financial profits of investors in the short term has been our nightmare. The mind-formatting of MBA programs, producing hosts of next-quarter-oriented managers and executives has long time been the doom of our civilization.

However, Life has its balances and those who have the patience to wait long enough, like ancient Chinese philosophy teaches us very well, one day they will see the corpse of their enemy pass slowly along with the downward river current. Today is the day. Well, just about to be, but well on the way.

A recent article published by HBR (heartily recommended: May – June issue, 2019) “The Investor Revolution” points out to an extremely interesting situation: in today’s world, the most financially oriented subjects, investing firms and asset management companies, are in the driving seat of the sustainability transition. Well, this is a bit an optimistic vision, nonetheless the research illustrated in the article clearly says that the most financially savvy people are those who strongly require companies they invest in to incorporate ESG strategies and actions into their core principles.

Indeed it is true that among the most interested people I encounter as CEO of Exsulting, and chief promoter of our Embedded Sustainability Index® process, are people from insurance and financial institutions. Why is it so? In my opinion this is because they are the best people around to assess risks, and they are the ones better perceiving that humanity is about to hit the doom’s threshold on this planet if we don’t engage thoroughly in the transition to sustainability and the circular economy. I have just returned from a tour of speaking engagements in conferences about sustainable development and the data I have heard from scientists who are knowledgeable on the issue of climate change are scary. The global economy looms on the verge of recession while social injustice and imbalances are not improving, rather the opposite, in many areas of the world.

Companies that are insuring their customers against risks perceive the tension mounting around, with the likelihood and potential impact of many risks increasing dramatically. Banks and institutions bearing the fiduciary duty of investing decisions are seeing the increasing relevance of such risks on the opportunity assessment of their investments.

Then here is the paradox kicking in: as the mentioned article clearly says, “concentration in few hands of the management of trillions of currency has made them powerless in hedging against the global economy: they have become too big to let the planet fail”. Hence all the ruthless efforts made in the past to exploit every square inch of the planet, and every drop of sweat of the last worker in the most distant Country, have led the hyper-capitalists to a point where they have to incite their acolytes to care.

The article says that ESG considerations are “almost universally top of mind” of such companies’ executives, besides quoting research gauging at more than half of global asset management companies those considering or evaluating ESG factors in their investment decisions. A steadily growing trend. But this is just commonsense, guys: data about the fact that sustainability pursuing companies outperform their peers who don’t are now abundant and solid. As in the title of my 2015 book “It’s Good Business to do Good with Business”, nowadays it is indisputable.

Why, thus, are there still so many difficulties preventing a thorough engagement in sustainability by the “common business person”? I think that there is still the ambiguity that some professionals are perpetuating between “sustainability-CSR-greenwashing-style” and “Embedded Sustainability” as a strategic tool. The former is purely an addition of costs to the company’s operations in an attempt to boost the image of the company or brand. I wholeheartedly advise against such an approach, and my regular readers will know how adamant I am on this. The latter, Embedded Sustainability, is in today’s world the best way to practice excellence in running an organization. Not by whim we named our innovative approach the Embedded Sustainability Index®: we know that the way to reap the many benefits of sustainability, among which those that the finance – insurance guys look for, i.e risk reduction, opportunity maximization – is to plant it at the core of a company’s culture and processes. Sustainability must be the guiding set of principles driving the decision making, from the Vision setting on, and guiding the process and product/service design and management. It has to be “everybody’s job” within the organization and through a strong stakeholder engagement it has also to include the most relevant among them, in a culture of partnership and collaboration, in the pursuit of common goals.

Therefore the paradox is working for the best, and in our effort to foster the sustainability transition, we have now unexpected allies. Yet they are welcome, because a lot of resources are needed to make the investments (NOT added costs: investments, with good ROI) that are necessary for the U-turn that our (human) irresponsible actions have made unescapable to maintain the ecosystem that we need in order to survive. The “side effect” of creating a much happier, wealthier and healthy society will be a welcome byproduct, of course.